Hybrid Line of Credit: Flexible Financing Options from Your Wyoming Credit Union

Hybrid Line of Credit: Flexible Financing Options from Your Wyoming Credit Union

Blog Article

Let Loose the Power of Cooperative Credit Union for Your Financial Resources

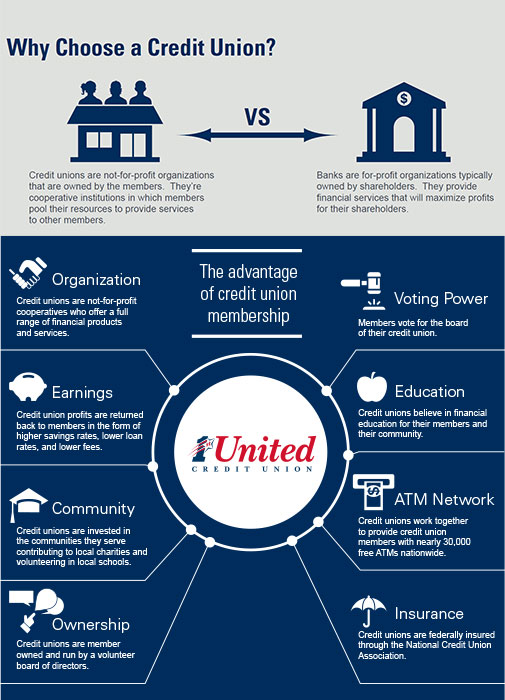

Discover the untapped possibility that lending institution hold for your financial well-being. From exclusive benefits to a more customized method, cooperative credit union supply an one-of-a-kind economic landscape that can boost your economic standing. By straightening your monetary goals with the know-how and neighborhood focus of cooperative credit union, you can unlock a world of possibilities that traditional banking might not give. Explore just how credit unions can revolutionize the means you handle your funds and lead the course towards an extra safe and secure economic future.

Benefits of Joining a Cooperative Credit Union

Joining a lending institution offers countless advantages for individuals looking for monetary stability and community-oriented financial services. One crucial benefit is the customized interest and customized economic services cooperative credit union give to their members. Unlike traditional banks, lending institution are member-owned cooperatives, permitting them to concentrate on the details needs of their neighborhood as opposed to making best use of earnings for shareholders. This member-centric method typically leads to lower costs, affordable rate of interest rates on car loans and savings accounts, and a much more versatile financing procedure.

In addition, lending institution are recognized for their outstanding customer care, with a strong focus on structure long-lasting relationships with their members. This commitment to personalized solution indicates that members can anticipate a higher level of care and assistance when managing their funds. Additionally, lending institution often provide economic education and learning programs and resources to assist participants boost their financial proficiency and make notified choices concerning their money.

Saving Money With Lending Institution

Cooperative credit union use cost-efficient financial services that can aid individuals save money and accomplish their economic objectives. Among the key means credit history unions help participants in conserving cash is via greater rate of interest on interest-bearing accounts contrasted to typical financial institutions. By gaining more on their deposits, participants can see their savings expand faster over time. Additionally, credit report unions commonly have reduced costs and account minimums, making it less complicated for participants to maintain even more of their hard-earned cash.

An additional advantage of conserving cash with lending institution is the tailored solution they offer. Unlike big financial institutions, cooperative credit union are member-owned and focus on the health of their members. This means they are a lot more inclined to supply tailored suggestions and products to aid individuals conserve successfully. Moreover, lending institution usually provide economic education sources, such as workshops or online tools, to aid members make educated decisions and boost their saving behaviors.

Borrowing Sensibly From Cooperative Credit Union

When taking into consideration economic options, individuals can take advantage of the loaning possibilities supplied by lending institution to gain access to inexpensive and tailored finance items. Cooperative credit union are not-for-profit financial organizations that prioritize their members' monetary wellness, usually supplying reduced passion prices and fees compared to standard financial institutions. By obtaining intelligently from lending institution, people can take advantage of individualized solutions and a much more community-oriented strategy to lending.

One of the essential benefits of borrowing from credit score unions is the possibility for reduced passion prices on lendings - Wyoming Credit Union. Credit history unions are known for supplying affordable rates on various kinds of fundings, including individual financings, car car loans, and mortgages. This can cause considerable cost financial savings over the life of the funding compared to obtaining from traditional financial institutions

Additionally, credit rating unions are extra versatile in their lending requirements and may be a lot more ready to collaborate with members who have less-than-perfect credit scores. This can provide people with the opportunity to access the funds they require while also boosting their credit history with time. By obtaining sensibly from lending institution, people can achieve their monetary objectives while developing a positive connection Credit Unions in Wyoming with a relied on financial partner.

Preparation for the Future With Cooperative Credit Union

To protect a secure economic future, individuals can tactically straighten their lasting objectives with the extensive planning solutions supplied by credit scores unions. Lending institution are not nearly lendings and cost savings; they likewise give valuable monetary preparation help to aid participants achieve their future ambitions. When intending for the future with cooperative credit union, participants can profit from customized financial advice, retired life preparation, investment assistance, and estate planning services.

One trick benefit of making use of lending institution for future planning is the tailored strategy they offer. Unlike conventional banks, lending institution often put in the time to comprehend their participants' one-of-a-kind economic scenarios and tailor their services to meet specific demands. This individualized touch can make a considerable difference in assisting members reach their long-lasting economic objectives.

In addition, lending institution generally prioritize their participants' monetary health useful link over revenues, making them a relied on companion in planning for the future. By leveraging the know-how of cooperative credit union professionals, members can develop a strong economic roadmap that aligns with their desires and sets them on a course in the direction of long-term financial success.

Achieving Financial Success With Cooperative Credit Union

Leveraging the monetary experience and member-focused approach of cooperative credit union can pave the means for people to accomplish long-term financial success. Credit unions, as not-for-profit financial cooperatives, prioritize the financial wellness of their members over all else - Credit Unions in Wyoming. By coming to be a member of a credit scores union, people gain access to a variety of economic products and solutions customized to meet their certain needs

One vital method credit score unions assist members accomplish financial success is through using competitive rate of interest on cost savings accounts, fundings, and charge card. These favorable prices can result in significant cost savings with time compared to conventional financial institutions. Furthermore, lending institution often have reduced charges and more individualized client service, cultivating a supportive environment for participants to make audio financial choices.

In addition, cooperative credit union commonly provide monetary education resources and counseling to assist members improve their economic literacy and make informed options. By taking benefit of these services, people can develop strong money monitoring skills and work towards attaining their long-term financial objectives. my company Eventually, partnering with a lending institution can empower people to take control of their funds and establish themselves up for a safe and secure monetary future.

Verdict

To conclude, the power of lending institution exists in their ability to provide individualized interest, tailored financial services, and member-owned cooperatives that focus on community requirements. By signing up with a lending institution, people can benefit from lower fees, competitive rates of interest, and exceptional customer care, leading to conserving money, obtaining sensibly, preparing for the future, and accomplishing financial success. Embracing the special advantages of lending institution can assist individuals secure their economic future and enhance their overall financial well-being.

Credit history unions are not-for-profit monetary organizations that prioritize their members' economic health, frequently using lower passion rates and costs contrasted to standard financial institutions.In addition, credit score unions are much more adaptable in their borrowing standards and might be more ready to work with participants who have less-than-perfect credit score.One crucial means credit rating unions assist members attain economic success is with supplying affordable rate of interest prices on cost savings accounts, lendings, and credit scores cards.In addition, credit unions typically use economic education and learning sources and counseling to help participants boost their economic literacy and make informed choices.

Report this page